Japan’s Boomers and Seniors Don’t Like Digital. Why That’s a Problem.

In the Land of the Rising Sun, where tradition meets technology, Japan is navigating a digital crossroads. Despite pioneering 3G technology and boasting a vibrant mobile culture, the nation finds itself grappling with a curious paradox: While at the forefront of technological innovation, its digital engagement metrics tell a different story.

In a society where mobile phones are lifelines and eCommerce thrives with virtual shopping experiences, Japan’s embrace of social media for business has been hesitant, reflecting deep-seated cultural nuances and infrastructure challenges. This dichotomy underscores Japan’s journey toward digital transformation, where the promise of “Society 5.0” beckons — a vision of cashless cities and streamlined industries — but where adoption hurdles persist.

As Japan seeks to harness its technological prowess to overcome demographic hurdles and revitalize its economy, the path to digital engagement remains both a challenge and a beacon of opportunity.

Despite being the fourth-largest economy in the world with a population of 125 million, Japan holds the bottom spot among the 11 countries studied in PYMNTS Intelligence’s “How the World Does Digital” report, which examines the digital behaviors of more than 817 million consumers across countries such as Brazil, Singapore, the United States, Spain and Germany.

By the Numbers

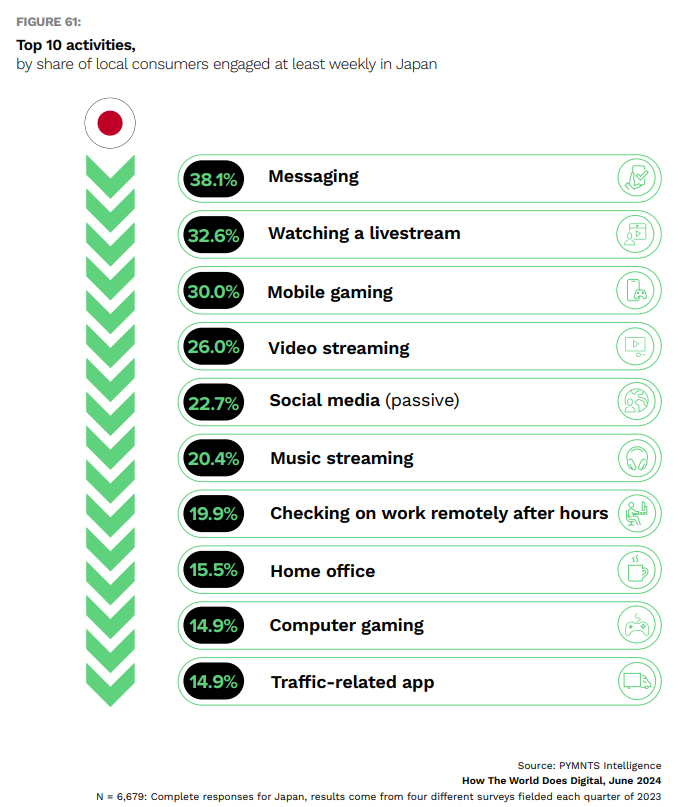

Video streaming leads as the most popular digital activity among Japanese citizens, with 38.1% engaging in it weekly. Watching a livestream (32.6%) snags the runner-up spot, followed by mobile gaming (30%), video streaming (26%), and passive social media (22.7%).

Music streaming (20.4%), checking on work remotely after hours (19.9%), home office (15.5%), computer gaming (14.9%) and traffic-related apps (14.9%) complete the top 10 most popular weekly digital activities among Japanese citizens.

Messaging tops the list for monthly engagement, averaging 9.4 days per month. It is followed by watching a livestream (8.6 days), mobile gaming (8 days), video steaming (6.5 days), and passive social media (6 days).

The top 10 monthly digital activities also include music streaming (5.2 days), checking on work remotely after hours (4.8 days), traffic-related apps (4.7 days), shopping on a marketplace (4.6 days) and online banking (4.1 days).

In Japan, Generation Z leads in digital engagement with 244 activity days, followed by millennials (178 days), Generation X (112 days), and baby boomers (87 days). Among income groups, high-income earners are the most digitally active (159 days), followed by middle-income (122 days) and low-income earners (96 days).

Lower Digital Engagement

When assessing Japan’s technological adoption, despite its pioneering role in innovation, digital engagement metrics often lag behind. While Japan was an early adopter of 3G mobile technology, pervasive digital engagement hurdles persist, stemming from cultural and infrastructural complexities.

Japan boasts a robust mobile culture where phones transcend mere communication tools to encompass shopping, payments and service access.

Despite this prevalence, the uptake of digital engagement platforms like social media for business remains tepid compared to global counterparts. Social media usage in Japan, notably platforms like Twitter, diverges in usage patterns from other nations, with a predominant focus on information sharing rather than personal updates. Such distinctions impact international comparisons of overall engagement metrics.

Digital engagement metrics, however, vary due to distinct consumer behaviors and preferences, influencing global rankings in digital engagement assessments. Cultural values profoundly shape Japan’s digital landscape, influencing engagement trends through privacy concerns, a preference for direct communication, and steadfast brand loyalty, distinguishing it from countries with divergent cultural underpinnings.

Looking Ahead

Japan’s digital evolution is reshaping industries, propelling economic growth and enriching lifestyles through strategic investments in sectors such as HealthTech and FinTech. The adoption of telemedicine, for instance, is revolutionizing healthcare accessibility, particularly crucial for Japan’s aging populace and rural communities.

Embracing the vision of Society 5.0, Japan looks toward a cashless economy, smarter urban environments and streamlined supply chains, which offer heightened living standards and economic efficacy. Industries like eCommerce and banking are leveraging faster transactions and personalized services, emblematic of Japan’s pivot toward digital fusion.