More Than Two-Thirds of US Consumers Now Subscribe to Amazon Prime

Amazon Prime membership is on the rise, encompassing the majority of consumers, but PYMNTS Intelligence data shows that Walmart’s quickly growing membership is becoming a force to be reckoned with.

By the Numbers

This year’s installment of the PYMNTS Intelligence Amazon Prime Day study draws from a survey of nearly 6,000 United States consumers to understand their subscription and spending habits with retail giants Amazon and Walmart.

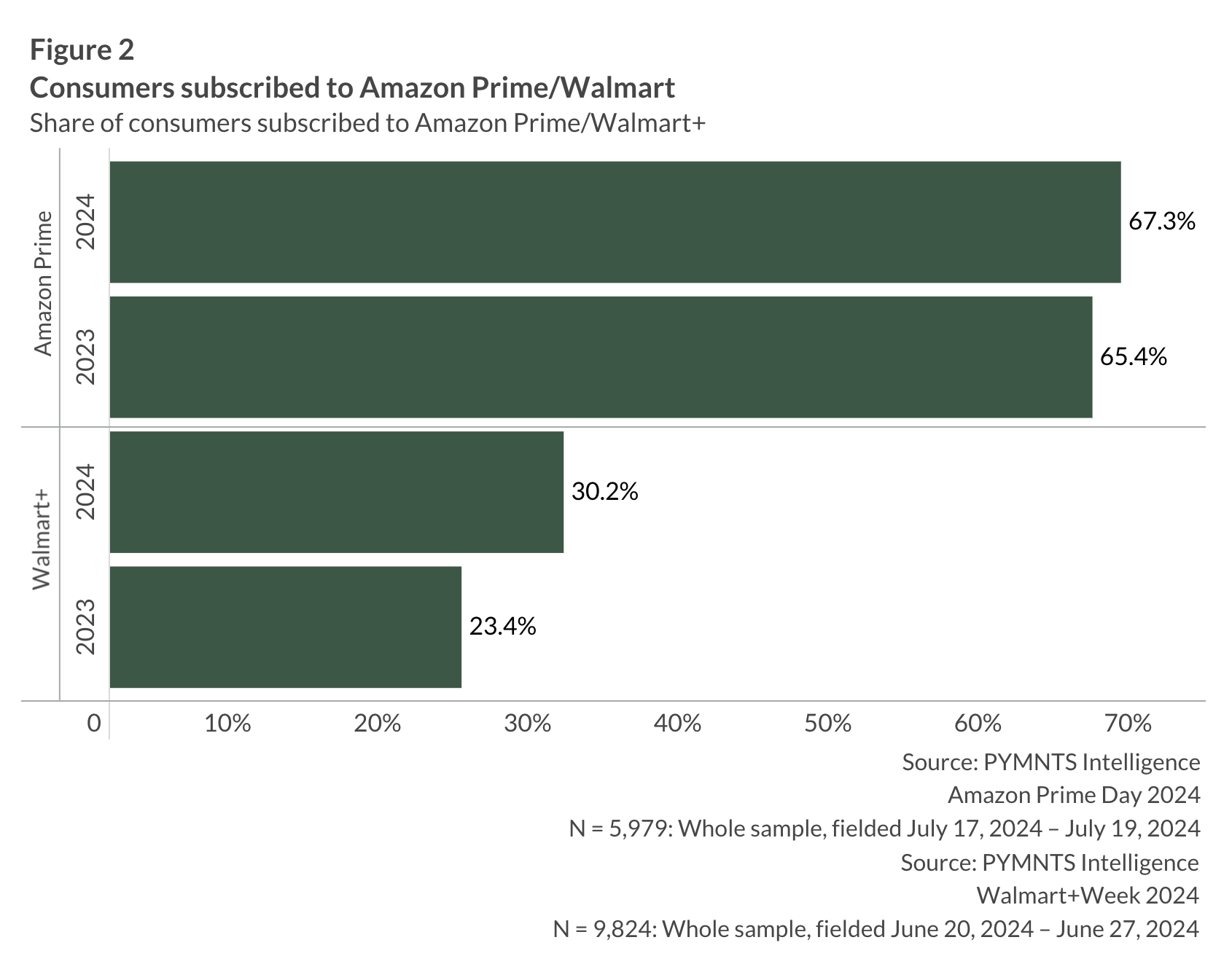

The results revealed that, while far more consumers are subscribed to the former’s paid membership program, the latter’s is growing faster. Specifically, as of this year, 67.3% of consumers reported that they are members of Amazon Prime, up from 65.4% last year. Conversely, only 30.2% of consumers subscribe to Walmart+, but that share marks a considerable increase from last year, when it stood at only 23.4%.

As such, Amazon Prime membership rose a little less than 3%, while Walmart+’s subscriber base grew by an order of magnitude more, rising more than 29%.

The data underscores the shifting dynamics in the retail subscription landscape, with Amazon Prime maintaining its lead in sheer numbers, while Walmart+ experiences rapid growth, signaling a potent competitive threat.

The Data in Context

Amazon Prime’s members are spending more and more. In its recent Prime Day event, the eCommerce giant shared that it saw “with record sales and more items sold during the two-day event than any previous Prime Day event.” Plus, external estimates hold that the company saw an 11% increase in spending over the course of the event compared to last year, reaching $14.2 billion.

Walmart seems to have experienced a decline in participation in its summer sales event among Walmart+ members. According to the PYMNTS Intelligence report “Walmart+ Week 2024,” which surveyed over 7,700 U.S. consumers, 14% of consumers made a purchase during the event, a drop from the 20% reported last year.