For shoppers with the most cash to burn, PYMNTS Intelligence data reveal, store-specific card-linked rewards go the longest way toward driving spending.

The report “Card-Linked Offer Growth Hinges on First-Time Users,” a PYMNTS Intelligence and Banyan collaboration, drew from a February survey of more than 2,100 U.S. consumers to better understand how and why they started using card-linked offers.

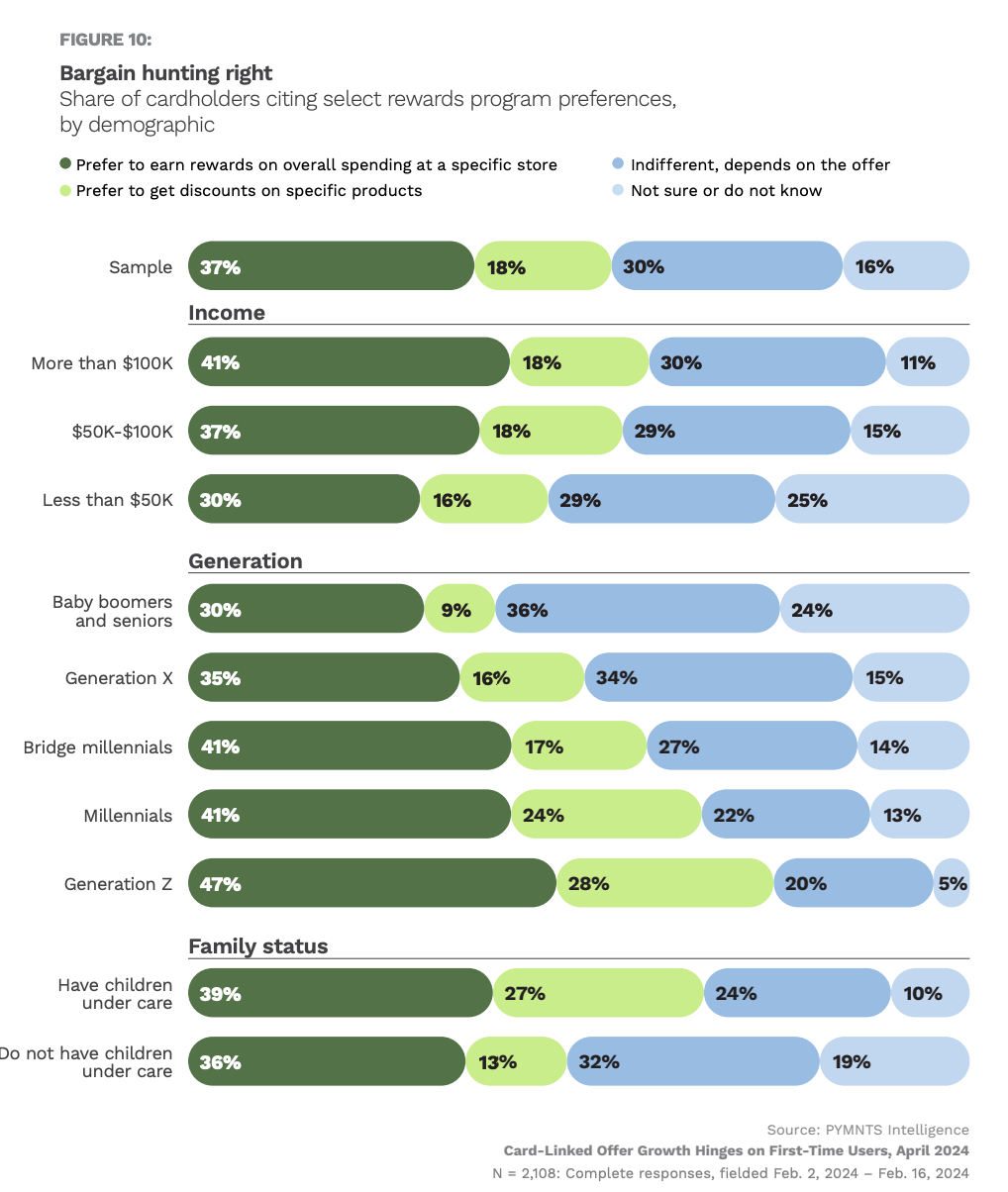

The results revealed that 41% of consumers who make more than $100,000 a year prefer to earn rewards on overall spending at a specific store, while only 18% prefer discounts on specific products, 30% are indifferent and 11% are unsure.

These figures showed that higher-income shoppers are likelier than the average consumer to want store-specific rewards, as only 37% of the sample overall exhibited the same preference.

The study also found that younger consumers — namely, Generation Z shoppers, millennials and bridge millennials — were disproportionately likely to want store-specific rewards. As such, by offering card-linked rewards, retailers have a good chance of winning the spending of wealthier and younger shoppers.

Conversely, there may be drawbacks for retailers in offering card-linked rewards across their offerings rather than focusing on item-specific perks.

“I think card-linked offers have been a rather blunt instrument in a retailer’s marketing toolkit,” Jehan Luth, CEO of Banyan, told PYMNTS in a 2022 interview. “One of the biggest reasons it’s a blunt instrument is because as a retailer, I cannot drive traffic to certain items. Instead of traditional loyalty offerings that may not be consumer-personalized, the overlaying of SKU-level data or item-level data in rewards and offers makes card-linked offers a much more versatile and powerful tool in the toolkit for retailers.”

The space may be due for a change soon, as the Consumer Financial Protection Bureau (CFPB) investigates the way that credit card rewards programs are designed following a rise in consumer complaints about such programs.