80% of Food Delivery Service Users Say Saving Time Is Key Draw

Third-party restaurant delivery aggregators fed a nation for the pandemic years, but with COVID in the rearview and inflation the greatest danger to consumers, the convenience of having pricey salads appear at the front door is losing some of its luster.

We explored the changing patterns of restaurant aggregators in “Connected Dining: Third-Party Restaurant Aggregators Keep the Young and Affluent Engaged,” a PYMNTS report based on a March survey of nearly 2,290 U.S. consumers.

Among the marquee findings of that research is the fact that only 5% of consumers made their most recent food purchase through a third-party platform in the last six months.

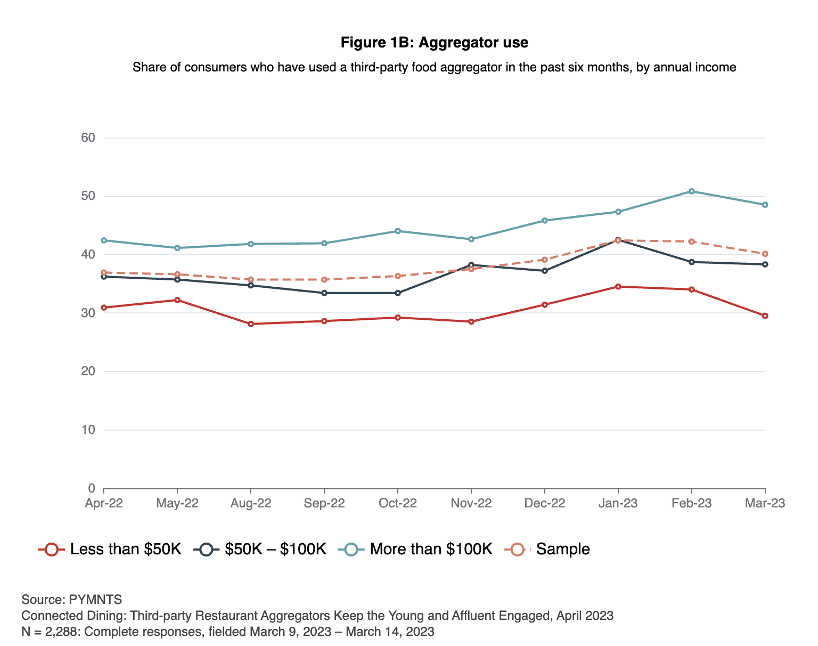

Do the math and it tells us that “In the last six months, 40% of all survey respondents have used an aggregator at least once, meaning most U.S. consumers have not used a food aggregator in at least half a year.”

That doesn’t mean it’s lights-out for DoorDash, Uber Eats, Grubhub and the rest of that competitive set.

PYMNTS data found that 44% of aggregator users made more purchases via aggregators this year than last year. We found that “high shares of Generation Z consumers (69%) and those annually earning more than $100,000 (48%) continue to use food aggregators,” adding that “A small user base is much more palatable if it is young and affluent.”

Moreover, we found that close to three times as many consumers made their most recent food purchase through a first-party app than a third-party aggregator, at 13% and 5%, respectively. Understanding the reasons that the most affluent and young consumers keep engaging with aggregators is useful to the growing number of restaurants fielding direct first-party apps.

Per the study, “Aggregator lovers, or at least those using the platforms more frequently than last year, were particularly likely to agree that they use these platforms when they lack time to prepare food, at 80%, that they try new restaurants via these platforms, at 74%, and that aggregators give them more control of the specifics of their meals, at 80%.”

Compare that to reasons consumers decreased their use of aggregators: 70% said they save time; 47% said the platforms expose them to new restaurants; and 65% believe the food received from aggregators is of higher quality, “suggesting that bad experiences may have led them to use alternative channels.”

Read the report: Connected Dining: Third-Party Restaurant Aggregators Keep the Young and Affluent Engaged